Neillsville Dairy Breakfast – June 12, 2022 – Boone Farms N6634 STH 73, Neillsville

Republican Party of Clark County Events

Republican Party of Clark County Events

June 23 – 23rd Dist. Candidate Forum – Jesse James * Sandra Scholz * Brian Westrate –Neillsville American Legion 6:00pm

July 10 – Neillsville Heritage Days Parade 1:00pm

July 12-14 Farm Technology Days – Red Agricultural Tent

July 27 Greenwood Park, Lone Rd. 4:00pm

August 28 Loyal Corn Festival Parade 12:30pm

Ron Johnson Announces Reelection Campaign

OSHKOSH – On Sunday, Ron Johnson announced he will run for reelection to represent the people of Wisconsin in the U.S. Senate. Senator Johnson was first elected in 2010 and was reelected in 2016. Ron Johnson first ran for Senate to fight for Wisconsinites and it’s clear that the fight is far from over.

“In 2010, I promised I would always tell people the truth and that I would never vote with re-election in mind. An extension of that promise is that I don’t conduct myself worrying about re-election. When re-election is not your primary motivation, those are easy promises to keep – and I have faithfully done so. That attitude is relatively unique in Washington, and it may be one reason why many appreciate having me involved in the national debate,” said Senator Johnson.

“So today, I am announcing I will continue to fight for freedom in the public realm by running for re-election. It is not a decision I have made lightly. Having already experienced a growing level of vitriol and false attacks, I certainly don’t expect better treatment in the future. In order for my campaign to succeed, I will need the support of every Wisconsinite who values the truth and refuses to allow lies and distortions to prevail.”

Senator Ron Johnson supporting our state.

. Rep Tom Tiffany – Follow on Twitter

Rep Tom Tiffany – Follow on Twitter

Prices for staples we rely on continue to rise, thanks to reckless and unsustainable government spending.

Gasoline 42.1%

Propane, kerosene, and firewood 27.6%

Gas Utilities 20.6%

Meats 12.6%

Eggs 12.6%

We all feel it.

Senator Ron Johnson – Follow on Twitter

Senator Ron Johnson – Follow on Twitter

Andrew McCabe lied to his own FBI investigators. Others go to jail for that crime; he gets to retire with full pension. Another grotesque example of unequal justice and the corrupt deep state. How disgusting.

https://www.washingtonexaminer.com/news/former-fbi-official-andrew-mccabe-wins-full-pension-in-wrongful-termination-lawsuit-settlement

Republicans in Clark County, Wisconsin, Announce County ‘Recount’ Results

On August 25th and 26th the Republican Party of Clark County Wisconsin closely observed a ‘recount’ of the 2020 election which they commissioned and was carried out by the County Clerk. Members of the Executive boards of both the Clark County Republicans and Democrats were witnesses.

Over the course of two days, all of the ballots from all of the voting precincts in the counties were counted and compared to the official results. The process was limited only to this effort, and did not even attempt to authenticate absentee ballots or examine the issue of the ‘indefinitely confined’ voters, which has created so much consternation both within and without the state of Wisconsin.

Issues such as these would be settled by what is being termed as a ‘forensic audit.’ The Clark County Republican Party passed a resolution earlier in the month calling for a state-wide ‘forensic audit and looks forward to it being carried out.

For perspective, there were 3,492 votes cast by mail in the county in the 2020 election, 694 of which were ‘indefinitely confined.’ According to the Wisconsin state government, 20.4% of ‘indefinitely confined’ voters did not provide ID before casting a ballot in the 2020 election. This, combined with concerns about the integrity of how the election was administered elsewhere in the state, explains why many voters in Clark County and elsewhere are skeptical about the 2020 election results in Wisconsin.

The Clark County Republican Party earnestly hopes that these issues are addressed head on and resolved before the next election, as confidence in our election results is an essential element of keeping our republic healthy.

All that said, the ‘recount’ carried out on August 25th and 26th reasonably establishes that the various voting precincts in Clark County, Wisconsin did faithfully and accurately convey the tallies of the ballots that was in the official report. In the vast majority of the approximately 50 voting precincts in the county, there existed an actual ballot consistent with each of the votes reported for Trump, Biden, and the other presidential candidates.

In short, the various voting precincts of Clark County Wisconsin accurately and competently administered the 2020 election.

As one might expect, given the level of scrutiny applied, there were some very minor discrepancies identified, some of which were due to individual voters casting ambiguous ballots, and occasionally some ‘clerical’ errors. The Republican Party of Clark County Wisconsin is confident that these did not materially impact the outcome of the county election and likewise confident that these instances will be used to further educate poll workers and voters themselves.

It has been said by some that given the fact that Trump won the 2020 election in the county by a 2 to 1 majority, there was no sense in ‘recounting’ the ballots. To the contrary, the Clark County Republicans believe that it is time for citizens to put into action Reagan’s maxim, “Trust, but verify.” On top of that, with so much suspicion surrounding the results elsewhere in the state and in other states, which the citizens of Clark County are powerless to do anything about, we can at least do what we can, which is to ensure that our own house is in order.

While conceding that there were important limits on what this ‘recount’ could show and not show, the Clark County Republicans are glad to report that this part of the house, at least, is in order.

The Republican Party of Clark County, Wisconsin, eagerly awaits the thorough reckoning that is due elsewhere in the state. After all, we all know (don’t we?) where the biggest problems lie: chiefly in Milwaukee, Green Bay, and Madison.

Efforts Under Way to Audit Election Results in Central Wisconsin County”

Published June 7, 2021 Suspicion and doubts about the ‘official’ results of the 2020 election permeate the entire country. All voters in Clark County deserve verification that our election was free of irregularities. The Republican Party of Clark County Wisconsin has concluded that the only way to vindicate the results in their own county is to count the votes again. To that end, they have initiated the process to do just that. The cost of the recount will be over $1,000 and the recount will begin once all of the funds have been raised. To donate, please mail a check to: RPCC, PO Box 183, Neillsville, WI 54456.

County Republican Chairperson, Rose LaBarbera, acknowledges that Trump won the county handily, but says that many people do not trust the machines. “That is why we’re going to do a hand recount. In theory, the results of the hand recount will exactly match the numbers the machines spat out. There is only one way to find out, and that’s to count them.”

LaBarbera points out that even a small discrepancy could have significant implications. “If Trump lost, it was only by 20,000 votes. A couple of hundred votes siphoned away from all the Trump counties wouldn’t be missed but could really add up.” There are reports of one machine in the county requiring several attempts before the ballot results matched what the voter intended. “We actually hope to find no problems with the vote count. That would be a great outcome,” LaBarbera said. “The recount will confirm the outcome. We can’t control what happens in other areas of the country, or in Madison or Milwaukee, but we can make sure our own house is in order. We urge other counties in Wisconsin to do the same.”

A website has been established to provide updates on the audit effort, at https://clarkcount.com/

“This is going to be a big project and require some financial investment. We hope that people will stand with us as we put into practice Reagan’s principle of ‘Trust but verify.’ They can start by going to our website and seeing how they can help,” LaBarbera said. For more information contact Rose LaBarbera at (715) 797-1388.

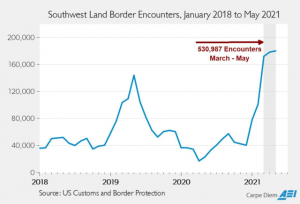

President Biden’s border crisis is getting worse with each passing day, as published in the Tiffany Telegram

More than 180,000 illegal aliens flooded into our country in May alone – the highest level we’ve seen in more than two decades. To put that number in perspective, it is more than twice the capacity of a sold-out Lambeau Field.

Even worse, the Biden administration admitted that almost 40 percent of the illegal aliens they encountered last month – many of whom fan out across America under the White House’s dangerous “catch and release” policy – are repeat offenders who have tried to enter our country illegally at least once already in the last 12 months.

The numbers are, simply put, staggering.

In just the last three months – from March to May – Customs and Border Protection officials have encountered more than a half-million migrants at our southwest border. And the tidal wave of migration isn’t slowing down.

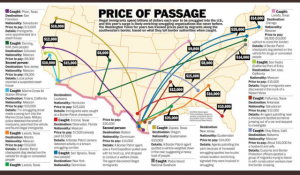

The human cost has also been shocking. An investigative report this week revealed that traffickers are enjoying record profits thanks to these misguided White House policy changes – with some individual smugglers now pocketing in excess of $200,000 a year from their illegal activities. Check out the infographics we’ve included below to get an idea of how big the scope of this problem truly is.

On Fed restriction on states to lower taxes – buried in the “American Rescue Plan”

One of the most partisan provisions congressional democrats quietly tucked into the hastily-passed $1.9 trillion American Rescue Plan (ARP) was language that sought to prevent republican-controlled state legislatures like Wisconsin’s from even trying to direct a portion of the $195 billion allocated to states into direct, albeit possibly temporary, tax relief. At issue is a provision in the law that could result in the Treasury Department being able to legally withhold – or recoup after the fact — ARP funds from any state that cuts any taxes. Wisconsin’s state government is set to receive over $3.4 billion in ARP dollars it doesn’t need (our 72 counties are in line to receive a crazy total of $1.1 billion, while over $1.2 billion will collectively flow to WI municipalities.)

The language in the new law quickly led to a lawsuit from 21 Republican attorneys general. In response Treasury Secretary Yellen indicated that states could still enact tax cuts in their budgets — provided that they are not offset using any of the federal funds congressional democrats have just showered down on them. Yellen also made clear that states that do choose to offset those cuts with federal funds will risk only the amount of funds used in the offset, not their entire pot of ARP money.

The Biden administration doesn’t want state legislatures to cut taxes because they know many, perhaps as many as half, will try to do just that! The lawsuit’s supporters say it’s not just about red states having the ability to cut their citizen’s taxes and backfill that lost tax revenue with ARP dollars, but also the Biden administration’s illegal attempt to try to dictate state policy decisions.

Meanwhile, all state legislatures, including ours, are anxiously awaiting further guidance from the Treasury Dept, which should include answers to some very specific questions asked, and arguments raised, in the attorneys general lawsuit.

Here’s a WSJ story on the issue from three weeks ago.

States Were Told They Can’t Use U.S. Covid-19 Aid to Cut Taxes. They Sued.

Republican lawmakers, attorneys general say provision under $1.9 trillion stimulus bill is vague and unconstitutional

By Kate Davidson

Updated April 14, 2021 11:49 am ET

A last-minute provision added to the $1.9 trillion coronavirus relief package last month is leading to a showdown between states and the Treasury Department over the limits of the federal government’s fiscal authority. The package, known as the American Rescue Plan, provided $195 billion for state governments to help offset soaring costs related to the pandemic and plug budget holes stemming from the economic downturn. Democrats added one important condition: States cannot use the money, directly or indirectly, to cut taxes.

Republican lawmakers and attorneys general argued the provision, which would apply for three years, is overly vague, unconstitutional and would unfairly penalize states in good fiscal health. Five states have filed lawsuits seeking an injunction against the provision—the first hearing is scheduled for the end of the month—and Republicans in Congress have introduced legislation to repeal it.

Meanwhile, state officials and tax-policy experts are pressing Treasury Secretary Janet Yellen to clarify how broadly her agency will interpret the legislation, and what will happen to states that run afoul of the law. The need for guidance is urgent for many states that must complete their budgets before the fiscal year begins on July 1.

“It is potentially a significant restriction on state fiscal authority, and some of that may come down to the Treasury guidance,” said Jared Walczak, vice president of state projects at the conservative-leaning Tax Foundation. “If this became a broad restriction, that raises serious constitutional questions.”

As the virus began to spread last year, widespread lockdowns triggered business closures and millions of layoffs that weighed on state tax revenue, while spending on jobless benefits, healthcare and other social services rose.

But not all states experienced the revenue shortfalls that most initially feared. About half have seen tax collection increase, thanks in part to the strength of the housing and stock markets, which boosted property and income-tax revenues, and a surge of federal aid such as stimulus checks and enhanced jobless benefits that propped up consumer spending.

Some states with strong revenues, including Idaho, Utah, Arizona and North Carolina, are weighing tax cuts for the coming fiscal year. Those plans are now complicated by the American Rescue Plan, which says any state that accepts the federal aid may not use it “to either directly or indirectly offset a reduction in the net tax revenue” of that state. Some states argue that provision interferes with their right to set their own fiscal policy.

One issue is how the federal government defines “indirectly.” If states use federal aid to pay police officers and firefighters, for example, then use the savings to lower taxes, that could be considered an indirect tax cut, Mr. Walczak said.

It is unclear how far that logic would extend. Among the questions states have asked: Would policy changes, such as new tax incentives for businesses, be considered indirect tax cuts?

West Virginia’s Legislature has considered a bill that would extend a tax credit for charitable donations to nonprofit organizations and increase the annual cap from $3 million to $5 million—a change that would reduce state revenues.

“To this point, we have been very dissatisfied with Treasury’s response” to questions, West Virginia Attorney General Patrick Morrisey said in a statement. He outlined his concerns in a letter last month with 20 other state attorneys general.

Mr. Morrisey has filed a joint lawsuit with several other state attorneys general in federal court in Alabama seeking to block the provision.

“West Virginia is a sovereign state with the power to independently reduce its citizens’ tax burden and decide how taxpayer funds are spent,” he said.

In a response last month to the letter from the attorneys general, Ms. Yellen said nothing in the act prevents states from enacting “a broad variety of tax cuts.” Rather, it says the federal aid money cannot be used to offset a reduction in net tax revenue, she said in a March 23 letter. If states cut taxes but find another way to replace the lost revenue, that wouldn’t violate the provision, she said.

But Ms. Yellen has acknowledged that defining what it means to use the aid as a revenue offset is tricky. “Given the fungibility of money, it’s a hard question to answer,” she told the Senate Banking Committee on March 24.

The Treasury last week clarified that states that take steps to conform with federal tax-law changes—including recently enacted tax relief for unemployed workers—won’t be considered to have violated the prohibition on tax reduction. Ms. Yellen has said the Treasury is working quickly to provide additional guidance.

Phil Berger, the GOP leader of the North Carolina state Senate, said he has no concerns, based on Ms. Yellen’s March 23 letter, that tax cuts proposed by Republican state lawmakers will run into problems under the new federal law. North Carolina Republicans want to reduce the personal income-tax rate, increase the amount of income not subject to taxes and increase the child tax credit. The state’s tax revenues have risen between 2.5% and 5% since the start of the pandemic, according to data from the Urban Institute.

“We fully have the capacity to reduce taxes in the way that we have proposed,” Mr. Berger said, “and will not have to rely on the federal dollars in order to do it.”

Tax-policy experts and congressional Republicans want more certainty. Sens. Mike Crapo (R., Idaho) and Mike Braun (R., Ind.), and Reps. Kevin Brady (R., Texas) and Dan Bishop (R., N.C.), have each introduced separate measures in Congress to overturn the language.

Joe Bishop-Henchman, vice president of tax policy and litigation at the National Taxpayers Union Foundation, said the Treasury guidance should make clear what baseline the agency will use to determine whether there has been a net reduction in tax revenue and who will make the determination. The foundation is a nonprofit research group affiliated with a conservative organization.

Mr. Bishop-Henchman also called on Ms. Yellen to clarify that state tax-law changes announced or enacted before the American Rescue Plan was passed won’t be subject to the provision and to specify what action the Treasury will take if it finds a state has violated the provision.

“If they do all the things we recommend in the letter, I think everyone will be happy with it, but it may not change the fact that this provision probably exceeds what Congress can constitutionally do,” he said. “And Treasury cannot do anything about that.”

Write to Kate Davidson at kate.davidson@wsj.com

Election Reform: Florida and Kansas this week became the latest states to enact election reforms expanding voter ID and curbing ballot harvesting, among other measures.

Florida Gov. Ron DeSantis signed the reform live on “Fox & Friends” Thursday morning. Florida’s new law applies the same voter ID requirements to absentee voting as to in-person voting.

The new law restricts the practice of ballot harvesting by allowing a person to collect absentee ballots only for immediate family members. It also increases security for ballot drop boxes.

This comes two days after the Republican-controlled Kansas Legislature voted to override Gov. Laura Kelly’s veto of a bill limiting ballot harvesting.

Election Reforms Multiply in States Across Nation

Johnson Talks Border Crisis Transparency and Biden Administration’s Reckless Spending on ‘Newsmax’

In an interview with Newsmax on Wednesday, U.S. Sen. Ron Johnson (R-Wis.) discussed the lack of transparency surrounding the growing crisis at our southern border and U.S. increasing debt as the Biden administration continues its reckless spending.

A video of the interview can be found here, and excerpts are below.

“I think it’s kind of obvious exactly what the Biden administration’s doing here. They want to make sure that there aren’t any more pictures coming out of that Donna facility, and so they are getting different detention facilities to house these migrants so we can’t take pictures of it. They’ve been keeping the press out of Donna. They tried to prevent us from taking any pictures or releasing them. They were good enough to let us keep our phones, but then when we started taking pictures, our Biden administration minders were very similar to when you’re in communist China.”

“The press is by and large ignoring this, and once they start dispersing these migrants to different facilities or to hotel rooms, there won’t be any pictures available. So the result will be that there will be no story even though, Rob, over the last 28 days there were on average 5,900 migrants that have been apprehended at the southwest border each and every day. That’s a large caravan each and every day and there’s no end in sight. Of course as those numbers increase in terms of apprehensions, a lot more migrants get away, either known or unknown getaways. There’s a whole lot more drugs that could be trafficked over a very porous border, because CBP is all tied up trying to take care, as compassionately as they know how to, these migrant families and children.”

“The fact that the Federal Reserve is printing all this money and keeping interest rates ultra-low, who does that harm? It harms retirees on fixed incomes. And of course, if we inflate ourselves out of this debt, that’s going to harm those exact same retirees on fixed incomes but also low income individuals. So you have to understand the long term consequences of this as well as the dependency.”

Johnson Discusses Democrats’ Reckless Spending and Biden Border Crisis on ‘Fox Business’

U.S. Sen. Ron Johnson (R-WI) commented on the harmful impact of Democrats’ costly funding proposals and the failure of the Biden administration to handle the crisis at the southern border during an appearance on Fox Business’ ‘Mornings With Maria’ on Friday.

A video of the interview can be found here, and excerpts are below.

“From my standpoint, I am all for infrastructure. Our roads and bridges have been ignored for far too long, but we’ve already over-authorized spending. Let’s repurpose that amount of money. We don’t have to borrow more money, and we don’t have to further mortgage our children’s future.”

“They’re enacting their radical, left wing, socialist agenda. It’s what people like me were warning America about prior to the November 2020 election. What’s frightening about this Maria, is people are already suffering from all this borrowing. If you’re a retiree, and you’re on fixed income, what kind of return are you getting on your savings? If inflation takes off, those same retirees are going to be harmed, people on the lower end of the income spectrum are also going to be harmed. So there are real consequences to all this deficit spending and our growing debt.”

“President Biden and his administration are basically reversing all the positive policies of President Trump, a more competitive tax system, they’re going to start over regulating the economy again. Take a look at what they’re doing on border, dismantling what actually worked to reduce the flow of unaccompanied children and family units that are subject to those depredations, that inhumanity that you were talking to Jason Chaffetz about. What really needs to be pointed out is the Biden administration, Vice President Harris she was on my committee, they were fully aware of the human toll of their border policies, but they’re reversing all the successful policies of President Trump and I hope America is paying attention.”